Uncovering Japan’s 41 Hidden Unicorns

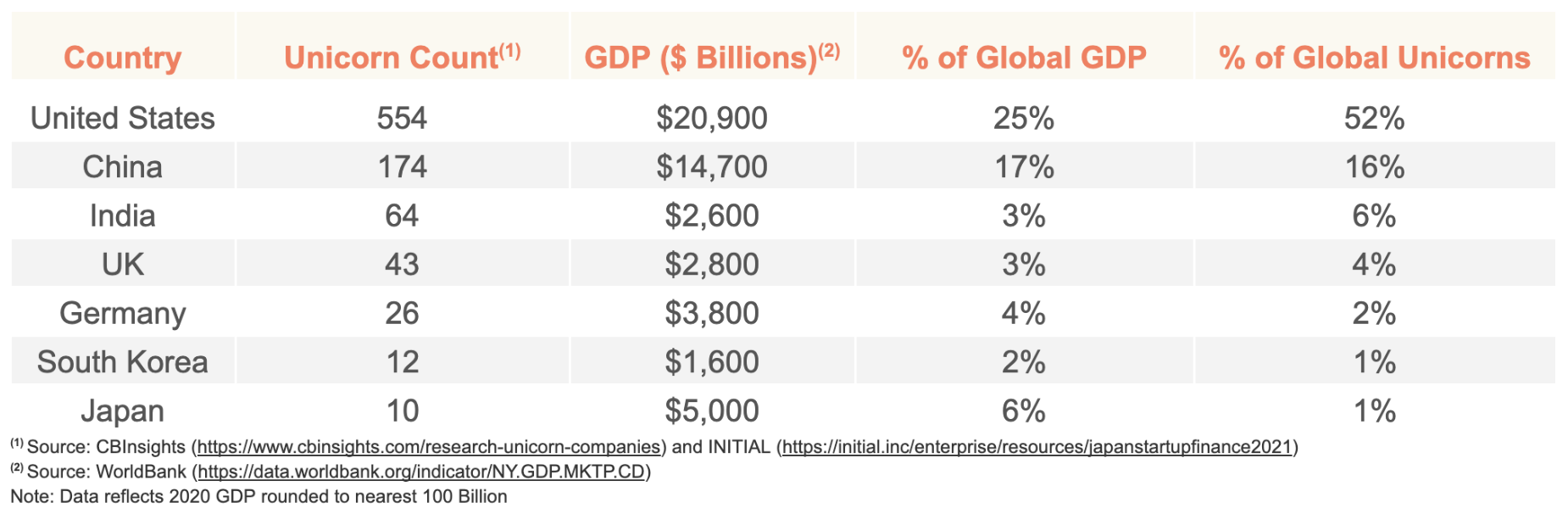

It’s no secret that Japan’s startup ecosystem doesn’t get much attention globally. This is due to the language and cultural barriers that exist, and perhaps more materially the notion that Japan does not generate many unicorns. Japan is currently home to only 10 unicorns compared to 554 in the US, 174 in China and 12 in Korea ーa country with a GDP only one-third of Japan’s. To understand the reason why there are so few unicorns in Japan, and decipher whether that is truly the case, it’s important to understand its unique startup landscape.

Startups in Japan typically exit via IPO rather than M&A. The ratio of IPO vs. M&A exits stands at around 8:2, compared to 3:7 in the US. This is due to 1) limited options for large financings and 2) low requirements to go public. In 2021, Japan raised only $9B from VCs, up 50% YoY, but still significantly lagging the US and China, which raised $128B and $130B respectively. To combat this and ensure that the stock market is functioning as a means for raising funds, the Tokyo Stock Exchange (TSE) has historically adopted lenient listing standards. The TSE reorganized its exchange structure in April, which included the merging of Mothers (Market of the High-growth and Emerging Stocks) and JASDAQ, into the new Growth segment. The minimum market cap of shares in circulation for listing on the Growth segment remained low post-restructuring at ¥500M ($4M). For comparison, NASDAQ’s liquidity requirement (Market Value of Unrestricted Publicly Held Shares or Market Value of Unrestricted Publicly Held Shares and Stockholders’ Equity) is $45M – about 11 times higher. Lenient requirements allow startups to seek direct financing and provide investors with liquidity, but going public can also invite pressure from public market investors for founders to focus on profitability instead of growth. Going public also entails missing out on the highly coveted unicorn label.

Unicorns are described as privately held technology companies that have reached over $1B in value. The world has become obsessed with the term “unicorn”, at times forgetting that it is merely a benchmark to gauge a startup’s success and not an all-encompassing label. Without understanding Japan’s financing backdrop, many overlook the startup ecosystem entirely, assuming that a lack of unicorns equates to a lack of successful companies. However, if you consider the public market dynamics described above, there’s more than meets the eye. Japan has nurtured many young companies that reached the billion dollar threshold. In order to better gauge startup success in Japan, we took a look at companies that went public in the country between 2011-2021 and reached a $1B valuation within 12 years of founding. Hereinafter we will refer to these companies as ‘hidden unicorns’.

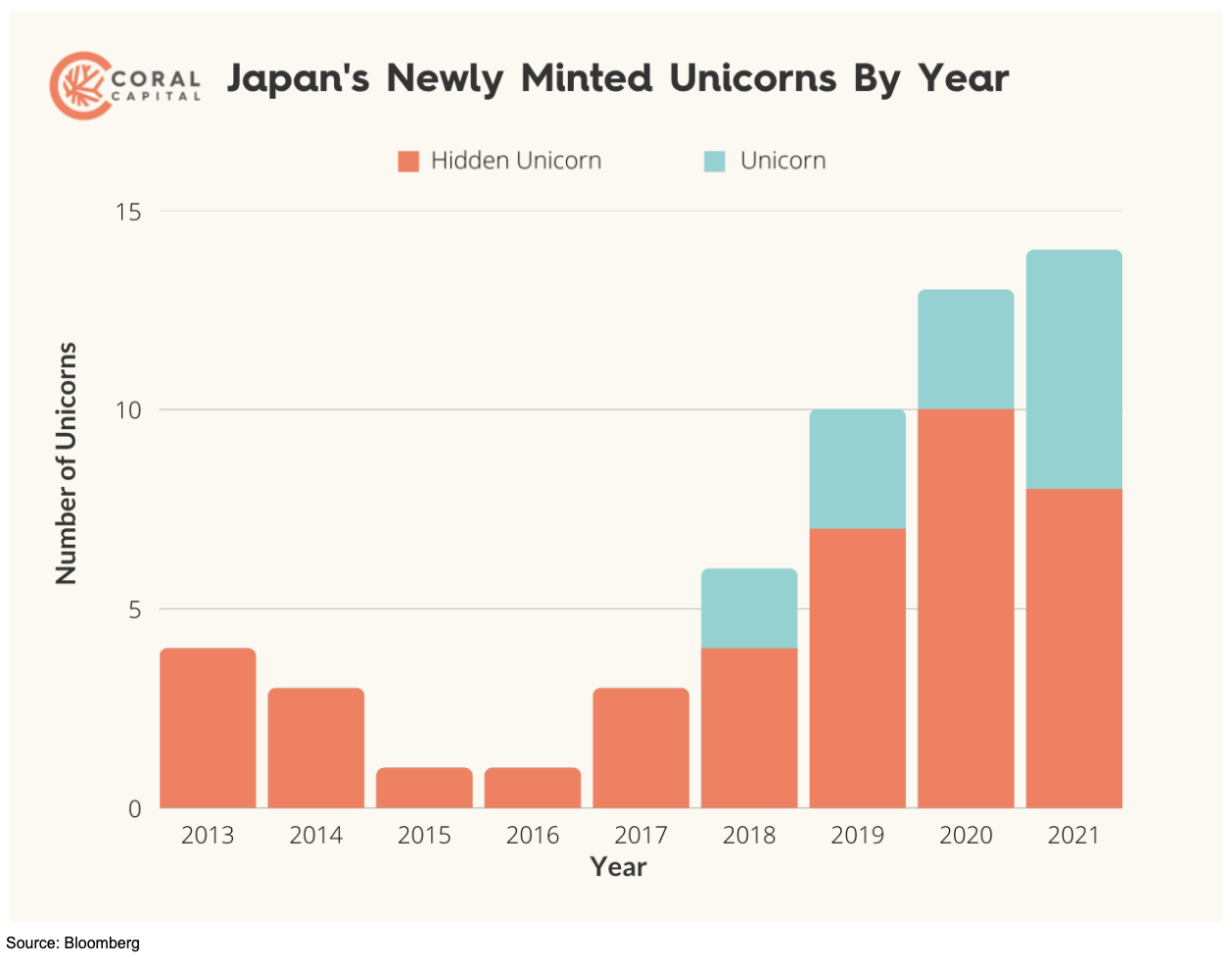

There are a total of 41 hidden unicorns. Note that this does not include holding companies or companies headquartered outside of Japan, such as AI-driven software company Appier. Headquartered in Taiwan, Appier achieved its billion dollar valuation through its IPO in 2021. Most of these ‘hidden unicorns’ went public on Mothers (now called Growth), with a small number of companies listing on the First Section and JASDAQ. They loosely follow industry trends. Earlier hidden unicorns were focused on Bio and Gaming, and in the later half of 2017 they shifted to AI, Fintech, Internet Software & Service, and Ecommerce.

Japan’s first unicorn is famously Mercari, which exceeded a billion dollar valuation in 2018. However, it wasn’t the first billion dollar startup. In 2013 for example, biotech companies Euglena (microalgae commercialization) and PeptiDream Inc (peptide pharmaceuticals) both exceeded the $1B benchmark 7 years after founding. More recently, there was HR software company Visional. Founded in 2009, the company only received an estimated $46M in venture financing before going public 12 years later in 2021. It raised ¥68B ($632M) through its listing, and hit its highest market cap of ¥386B ($3.4B) that same year.

Japan’s first unicorn is famously Mercari, which exceeded a billion dollar valuation in 2018. However, it wasn’t the first billion dollar startup. In 2013 for example, biotech companies Euglena (microalgae commercialization) and PeptiDream Inc (peptide pharmaceuticals) both exceeded the $1B benchmark 7 years after founding. More recently, there was HR software company Visional. Founded in 2009, the company only received an estimated $46M in venture financing before going public 12 years later in 2021. It raised ¥68B ($632M) through its listing, and hit its highest market cap of ¥386B ($3.4B) that same year.

Our data indicates that Japan’s hidden unicorns took an average of 6.8 years to IPO since founding, following a similar timeline to Series B financing rounds in the US. The average company then took about a year to reach a billion dollar market cap after going public, meaning that they reached unicorn status ~8 years after founding. This is in line with the average timeframe for global unicorns. In other words, startup IPOs in Japan have essentially served as Series B financings.

The global startup and venture capital ecosystem has developed quickly over the years, and Japan is no exception. We have seen a record number in venture capital raised, new VCs launched, and a more diversified pool of capital that includes foreign investors. The country’s largest business lobby, Keidanren, recently set ambitious goals to increase the number of unicorns from 10 to 100 within the next 5 years and expand the number of startups tenfold to 100,000. Japan has also established an astonishing ¥10T ($80B) national endowment fund for universities – the largest in the world. This fund aims to spur innovation in Japan’s universities and create a more favorable environment for startups. While Japan still has a long way to go, these initiatives reflect the country’s realization that it has to change quickly to catch up and become a dominant player in the global startup arena.

Associate @ Coral Capital