In my capacity as a fundraiser and spokesperson at Coral Capital, I frequently engage with some of the world’s most prominent institutional investors. Throughout these interactions, I often get to learn about what they have on their minds. Recently, a common theme stands out among these discussions: a growing interest in investing in Japan (I spoke about this briefly in a recent article on TechCrunch).

The shift towards Japan appears to be propelled by several converging factors. Firstly, a pervasive move away from China is apparent. From my conversations, I’ve noticed an increasing reluctance, among U.S. investors in particular, to continue making commitments into the Chinese private equity (PE) and venture capital (VC) asset classes. This is despite a historical track record of remarkable returns. The somewhat unpredictable crackdown on technology industries, coupled with the rising specter of conflict in Taiwan, has dampened enthusiasm. These political tensions and uncertainties are prompting caution, causing many investors to reconsider their long-term commitments. Consequently, they’re reassessing their allocations to Asia, and Japan emerges as a large and relatively predictable market within the region.

Secondly, the recent investment maneuvers of Warren Buffet, known for his strategic and value-centric approach, have brought Japan under the global spotlight. Buffet has significantly increased his stakes in five key Japanese trading houses, namely Mitsubishi, Mitsui., Itochu, Marubeni, and Sumitomo. Furthermore, his long-term strategy, coupled with indications of future investments in Japan, signals strong faith in the Japanese market. These actions have drawn attention to the investment opportunities in Japan, a country that not only shows potential for growth but also stability. The depreciating yen adds yet another layer of attraction for potential investors.

Lastly, performance numbers coming out of the Japanese buyout industry appear to be promising, and the word is spreading: Japan is proving to be a fertile ground for investment.

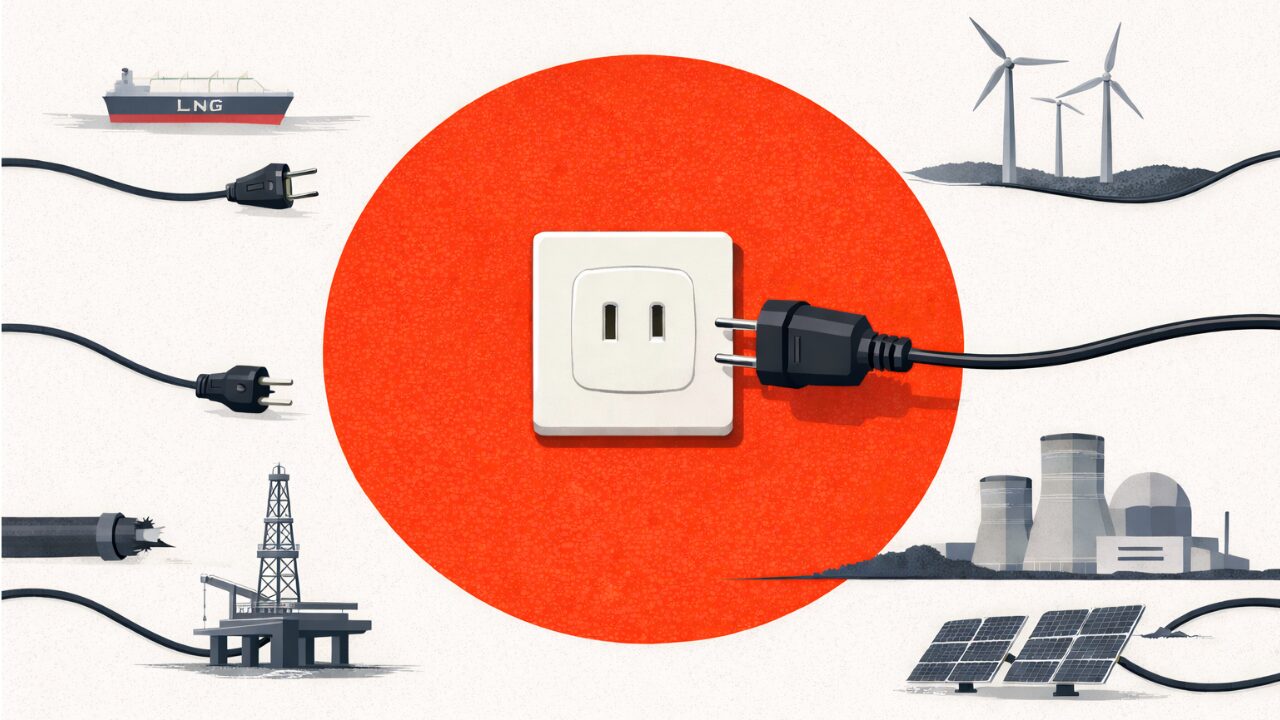

However, the question lingers: will this new excitement spill over into the VC sector and stimulate Japan’s startup ecosystem? The foundations of that trend manifesting certainly exist. In 2022, during a global ‘VC winter’, Japanese startups defied the odds, securing a record JPY 877.4 billion in funding—marginally exceeding the previous year and inching towards the trillion-yen (~$10 billion) landmark. This uptick can be partially attributed to an influx of new domestic VC funds, which have increased by nearly 40% in the past three years.

Nonetheless, it’s not all smooth sailing. Startups in the later stages, especially those preparing for Series D rounds and beyond, grappled with funding challenges in 2022, seeing a nearly 30% YoY decline in deal values. This slump was partially driven by a reduction in foreign investment, which saw a 13% YoY decrease in funding from foreign VCs. As stock prices on the Tokyo Stock Exchange’s Growth Market remain lackluster and IPO valuations dwindle, startups seeking to raise capital in Japan are navigating an increasingly fraught environment.

Despite these obstacles, the future is promising. Prime Minister Fumio Kishida’s government has allocated a staggering budget of JPY 1 trillion in 2022 to nurture startups, and detailed a five-year plan to multiply investment in Japanese startups by ten times, reaching JPY 10 trillion by FY2027 (~$100 billion). The government’s ambition is to incubate at least 100 “unicorns.” This bold blueprint, combined with the burgeoning vitality of Japan’s startup ecosystem, could herald an exciting new chapter of venture capital investment in the country. As global interest in the Japanese market continues to surge, we may start to see some of that global institutional money allocated to the VC opportunities brewing in the Land of the Rising Sun.