As James and Yohei‘s executive assistant, Kyoko is the backbone of Coral Capital. She helps make sure we get 10x done in half the time. She’s been with us since the early days of launching our first fund with 500 Startups, and is the secret weapon for our success.

Prior to joining us, she was an operations support lead for recruiting firm MRI Network covering APAC and EMEA. Before that she was at video streaming company J-Stream, where she worked on web video production and mobile application streaming.

In addition to keeping Coral Capital afloat, Kyoko is also a board game connoisseur, photographer, and supermom to her daughter and cat.

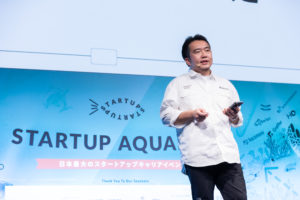

Startup Aquarium 2025[SB Test]

Startup Aquariumは、「スタートアップのキャリア」を様々な角度から学び、スタートアップの中の人とも楽しく話せる、年に1回のキャリアフェアです。スタートアップ転職を考えている方はもちろん、大企業やスタートアップで活躍中で転職は考えていない方や、中長期的なキャリアチェンジを考えている方にとっても、次の一歩に繋がる気づきや出会いができる場をご提供します。大盛況だった2024年に続き、4回目の今回はさらに企画をパワーアップして開催します!

- 50+の厳選スタートアップ

- 100+の登壇者(経営者やCXO、ベンチャーキャピタリスト ほか)

- 2000名+の参加者

- 1000件+の当日カジュアルマッチング

オフライン開催ならではの、深い交流や偶発的な出会いを生む「しかけ」を多数ご用意しますので、お楽しみに!

Featured Speakers Featured Speakers

James Riney

James is the CEO Founding Partner of Coral Capital, where he seeks to invest in founders building the most important companies in Japan across all sectors and stages from SaaS all the way to fusion. The firm has invested in some of Japan’s most promising startups, including Kakehashi, Kyoto Fusioneering, Hacomono, Kaminashi, and SmartHR, where James served on the Board.

Prior to Coral, James launched the first fund for 500 Startups in Japan, and before that he covered early stage investments for DeNA’s venture arm, focusing on Silicon Valley and Asia.

Before investing, he was the founding CEO of ResuPress (now Coincheck, one of the largest cryptocurrency exchanges in Japan), and the creator of STORYS.JP, the “Medium.com of Japan.” In another life, he worked at J.P. Morgan in New York and Tokyo. He grew up in Japan and speaks fluent Japanese.

In his free time, he is an avid snowboarder, diver, and yakitori connoisseur.

Yohei Sawayama

Before Coral Capital, Yohei was a co-founder of 500 Startups Japan, where he invested in over 40 companies. Prior to that he was a researcher at Nomura Securities, where he worked on tech IPOs including Gunosy ($300m), bengo4.com ($80m), FreakOut ($110m), and Voyage Group ($240m). Before Nomura, he covered the TMT sector for J.P. Morgan’s investment banking division. He worked on Sony’s acquisition of So-Net Entertainment for $785m, Toshiba’s acquisition of Landis+Gyrfor $2.3bn (ASIAMONEY Japan Best M&A 2011), and Bain Capital’s acquisition of Skylark for $2.1bn.

Before his career in finance, Yohei was an engineer. He received his Bachelor’s in Computer Simulation and Master’s in Nuclear Engineering from the University of Tokyo. He still codes regularly and is likely the only VC to win major hackathons in Japan.

Ryo Tsuda

Ryo leads our talent management initiatives. He builds our talent community through events and outreach programs to help our companies hire the best as quickly as they scale up. Prior to Coral Capital, he worked in Human Resources at GREE, covering mid-career recruiting and HRBP in both Tokyo and San Francisco. Before that he was responsible for financial planning and analysis at GE. He graduated from Waseda University with a degree in Law.

In his free time he is a dedicated surfer, hitting the waves year-round. “No surf, no life.”

Kyoko Kobayashi

Ken Nishimura

Before Coral Capital, Ken led the Google for Startups team in Tokyo, running an accelerator program and sourcing startup investments. Prior to Google, he ran TechCrunch Japan as Editor-in-Chief for about five years, growing both the site and their annual startup event TechCrunch Tokyo by over 3x during his tenure. As a seasoned tech journalist, he has worked for various publications both online and offline covering the software and internet industry for over 20 years. Throughout his career, he has also worked as an engineer, once as a Perl and Linux hacker, and once as a Rubyist creating a new web application for a media company. He received his Bachelor’s degree in Physics from Waseda University, and now serves as a part-time lecturer at Sophia University.

Iku Sakon

Iku is a Fund Operations Associate at Coral Capital. Prior to Coral Capital, she was a paralegal at Herbert Smith Freehills, with extensive experience in supporting cross-border dispute resolution and corporate transactions mainly in Europe, Africa and SouthEast Asia. Before that she was a translator at Anderson Mori & Tomotsune, and also has experience working at a Japanese trading company where she handled the import/export of food from the US, South America and China. She was born in Mountain View, spent her childhood in Chicago and graduated from the Tokyo University of Foreign Studies.

Yohei Shirata

Yohei leads recruiting for CXO and executive level positions across the Coral Family. Before Coral Capital, he worked for Persol Career recruiting for a wide range of roles, including engineering, business development, marketing, and back office positions. As a senior manager, he was also responsible for training team members, managing the team’s budget, and developing strategy. Before Persol Career, he worked at SBI Holdings where he held roles in IT sales and in web marketing strategy planning. He graduated from Waseda University with a degree in Commerce.

Ryotaro Ishikawa

Before Coral Capital, Ryotaro worked across various roles at Recruit, including human resources for sales and new business development, finance, accounting, corporate planning, and investment. In the investment division, he managed several Corporate Venture Capital funds (total USD 200M) and played a key role in establishing the blockchain fund (USD 25M), the first initiative in this area for Recruit. He received his bachelor’s degree in business management from Kobe University and MBA from HEC Paris Business School in 2021. As a Senior Associate at Coral Capital, he sources startups across a wide range of industries, as well as supporting fund operations across the firm.

His hobby is traveling. He has traveled around the world and visited more than 40 countries, from South America all the way to the Middle East.

Satoru Masuda

Satoru has worked across various publications as both a journalist and an editor for over 15 years. Before Coral Capital, he was the Creative Lead for BuzzFeed Japan, where he helped launch the advertising team and helped its turnaround. Prior to BuzzFeed, he was an editor and reporter for TechCrunch Japan and Impress Corporation covering the latest trends in startups and technology.

Ayumi Iwamoto

Ayumi joined Coral Capital in April 2022 and became Partner in July 2024. She is the first person outside of the investment team to become Partner at the firm and is responsible for Coral’s strategy and portfolio company support.

Prior to Coral, she spent more than 10 years at Recruit, the owner of Indeed and one of the largest tech companies in Japan, across a wide range of roles. In her early years she worked on sales and promotion strategies for “HOT PEPPER Beauty,” one of the largest review sites for beauty salons in Japan. In 2015, she moved to the New Business Development Office to launch TECH LAB PAAK, a startup co-working space and community for more than 1,000 people in startups, research, and social entrepreneurship. She later served as Executive Director, leading new business development initiatives, as well as serving as the project manager for the 2020 Olympics and Paralympics.

She enjoys good food, wine, and coffee. Her latest endeavor is also learning English.

Tiffany Kayo

Tiffany graduated from Clark University with a BA in Computer Science and Economics, and spent her senior year studying abroad at the London School of Economics. In college, she kickstarted a campus food sustainability app and conducted research with Boston University on human computer interaction. While her studies have provided her with a foundational understanding of technology, she found her true interests lie in the intersection of technology and business. Prior to Coral, she worked as an equity swaps sales trader at Morgan Stanley covering Japan, Australia and New Zealand.

Tiffany grew up between the Kansai area of Japan and the US (Hawaii, Las Vegas, San Diego).

Asami Saeki

Asami Saeki graduated from the Department of Educational Psychology, Faculty of Education, at the University of Tokyo, and then gained experience in corporate sales at Recruit for SUUMO. She joined Miraif Inc. as the third employee, where she worked as a dual-sided HR consultant providing recruitment and career transition support for startups. In addition she managed career programs, launched an alumni community, created culture decks, and developed internal portals. In 2024, she joined Coral Capital, where she is responsible for Coral’s startup community and managing Coral Beach, our office space for portfolio companies.

Her hobbies include golf, and she is currently studying English and design.

Mizuki Nakamura

Mizuki is a Fund Operation Associate at Coral Capital. Prior to joining Coral Capital in September 2024, she worked at Mitsubishi UFJ Capital for about 10 years, starting in 2014, where she was part of the Middle Office and focused on fund management and streamlining operations. Before that, she moved to Singapore and joined JAFCO Asia, marking her entry into the venture capital industry. Earlier in her career, she gained experience in retail sales at a securities company.

She earned a national qualification as a physical therapist after graduating from the International University of Health and Welfare.

Keigo Shimada

Blending deep academic insight with practical industry experience, Keigo serves as an Associate at Coral Capital. He earned a Doctor of Science in Gravitation and Cosmology from the Institute of Science Tokyo (formerly Tokyo Institute of Technology), where he published nine peer-reviewed academic journals and received a grant through the JSPS fellowship (DC2). Prior to joining Coral Capital, he was a data-driven consultant at ZS Associates, leveraging data science and AI to drive strategic initiatives for major pharmaceutical companies.

A lifelong resident of Japan, Keigo is fluent in English and Japanese. In his free time, he enjoys spending time with his cherished cat, crafting apps, analyzing data trends, fiddling gadgets, learning new languages, and taking peaceful long walks through the vibrant maze of Tokyo.

Haruna Katayama

Born in Japan and shaped across seven countries, Haruna brings a cross-cultural perspective and a drive to explore where underexplored needs meet technology. This curiosity has guided her work across disciplines — most recently at Boston Consulting Group, where she supported cross-border strategy in healthcare.

Before BCG, Haruna worked as an independent analyst at the intersection of women’s health, wellbeing, and technology, while completing graduate research in sexual neuroscience.

Haruna holds a BSc. from Minerva University and an MSc in Neuroscience from King’s College London. She is also a first-gen fellow at MasaSon Foundation and Yanai Tadashi Foundation, led by the Softbank and UNIQLO founders, respectively.

Rie Yano

Rie Yano is a serial entrepreneur and investor with deep expertise in the U.S. and Japanese startup ecosystems.

She founded Material World in New York in 2012, a pioneering fashion trade-in platform that redefined luxury resale. As CEO, she led product development, fundraising, global team building, and business development, culminating in the company’s acquisition by MIXI. After serving as GM of the U.S. entity post-exit, Rie returned to building and advising startups—now focused on longevity, AI, and robotics—while supporting cross-border expansion and early-stage innovation.

Rie began her career at Mitsubishi Corporation, working in both Tokyo and New York. She holds an MBA from Harvard Business School and a BA from Sophia University.

Naoki John Yoshida

Naoki is a Partner based in San Francisco, investing in companies with ambitions to expand globally, including Japan.

Prior to Coral, Naoki spent a decade at Hellman & Friedman, a preeminent global private firm focused on large-scale equity investments in high-quality growth businesses with $115b AUM. He helped lead investments in the technology sector and was a board director or was actively involved with UKG (including predecessor companies Ultimate Software and Kronos), Enverus, Splunk, Checkmarx and OpenLink Financial.

Naoki began his career at Morgan Stanley in New York in the Mergers & Acquisitions Group. He holds a B.S. in Applied Physics and B.A. in Economics from Cornell University.

Naoki is a first-generation Japanese-American, born in the US to Japanese parents. In his free time, he loves to travel & eat around the world with his wife and two young children, attempts to follow almost every sport, and dreams about returning to breakdancing.

Chikatomo Hodo

Chikamoto graduated from the Stanford University School of Engineering, and later joined Accenture. In 1991, he obtained an MBA from Columbia Business School. He became President and CEO of Accenture Japan in 2006, where he continued to lead the company through rapid growth as Chairman. He served as Vice Chairman of the Japan Association of Corporate Executives from 2017 to 2021.

Chikatomo Hodo currently serves as an external director for Mynavi, Konica Minolta, Mitsubishi Chemical Group, ORIX, Sumitomo Mitsui Banking Corporation. He is also a visiting professor at Waseda University, a member of the Management Council at the University of Tokyo, a trustee of the Japan Philanthropic Foundation, and is also engaged in VC investment and support for startups to bolster the Japanese economy and DX (digital transformation).

Naoki Aoyagi

Naoki Aoyagi is founder & CEO of newmo. He is a Senior Advisor to Mercari, where he has played a pivotal role in launching their payments and financial services business. He has also oversaw Mercari’s operations in Japan as SVP of the Japan Region and Marketplace CEO. Prior to Mercari, he served as CFO and Head of the Business Division at GREE and since 2011 he led the company’s global expansion out of California. He is also an active angel investor, investing in Coral portfolio companies SmartHR, justInCase, and ContractS.

太田 有紗

上智大学法学部3年生。大学では英米法やアジア法など国際関係の法律を勉強中。2024年9月からCoral Capitalインターン。主にBeach運営やイベントサポートを担当。趣味は旅行先で美味しいものをたべること。

門脇 慶

慶應義塾大学商学部4年生。国際経済学とマーケティングを勉強中。カナダ留学中にバンクーバーの日本人向けメディアを立ち上げ、影響力を利用し留学生の挑戦機会を増やすNPOを設立し代表を務める。Coral Capitalではインターンとしてコンテンツ作成やイベントサポートを担当。趣味はテニスで、日本とカナダでコーチ経験あり。

Event Map & Guide Event Map & Guide

Stage Time Table Stage Time Table

-

WHALE STAGE

11:50 – 16:25スタートアップ ピッチ(54社)

参加スタートアップ54社が3分間の限られた時間内に、自社の事業と魅力について、全身全霊でプレゼンをしていきます。ネットの文字情報だけからでは絶対に感じ取れない、スタートアップ各社が持つ強烈な匂いを感じ取れます。

16:40 – 17:25

16:40 – 17:25コンパウンドスタートアップの現在地

単一プロダクトにとどまらず、複数のプロダクトで成長を目指すコンパウンドスタートアップ。なぜ、この戦略が注目されているのか。急成長SaaSスタートアップのトップたちが議論します。

17:50 – 18:30スタートアップで日本は変えられるか?

日本の社会課題解決に向け、スタートアップはどんな役割を果たせるのか。規制改革の「一丁目一番地」と言われるライドシェア事業を展開するnewmoの青柳直樹さんとともに、スタートアップの可能性を深掘りします。

-

TURTLE STAGE

12:45 – 13:25コンサル出身起業家が語るスタートアップキャリアの創り方

コンサル出身の起業家が、スタートアップで本当に役立つコンサルスキルや、活躍するコンサル人材の共通点・落とし穴をリアルな経験を交えて語ります。

13:40 – 14:25ステージ別に解説:スタートアップで求められるスキルや挑戦

スタートアップの成長ステージごとに求められるスキルや、直面する課題はどう変わるのか。シードからシリーズDまでのスタートアップ起業家たちが、具体的な事例を交えて解説します。

14:40 – 15:25有力VCが予測する、2025年のスタートアップ業界

投資家視点で見た市場動向や成長領域とはーー。著名なベンチャーキャピタリストが、今後のスタートアップ業界のトレンドや注目分野について語ります。

15:40 – 16:25VC視点で解説、転職先スタートアップをどう見極めるか

経験豊富なベンチャーキャピタリストの目線で、転職先スタートアップの見極め方を解説します。伸びるスタートアップの共通点のほか、組織の規模に応じて求められる能力や役割の違いについても語ります。

16:40 – 17:25Bizサイドの人のための ディープテックの歩き方

ディープテックは技術に注目が集まりがちですが、実はビジネスサイドの役割が重要ーー。そこで成長ステージの異なる起業家たちが、ディープテックスタートアップで求められるビジネス畑(≒文系)の役割を徹底解説します。

-

DOLPHIN STAGE

12:45 – 13:25スタートアップ初期メンバーが語る SO報酬のリアル

日本を代表するユニコーン企業となったSmartHR。同社の立ち上げ期に生株を購入した初期メンバーが、生株の一部を売却して得た報酬のリアルを赤裸々に語ります。会場でしか聞けないオフレコセッションです。

13:40 – 14:20売れっ子放送作家がスタートアップ業界に転身したワケ

放送作家として「スマスマ」など数々のヒット番組を手がけ、現在はVCファンドを運営する鈴木おさむさん。40代にして放送作家を引退して異業種への転身を決断した背景や、今後の取り組みについて伺います。

14:40 – 15:25事業成長にコミットする CTOの流儀

急成長スタートアップのCTOたちは、事業全体の成長にどうコミットしているのか。その役割や取り組みを、リアルな事例を交えながら議論します。

15:40 – 16:25

15:40 – 16:25事業成長にコミットする CFOの流儀

急成長スタートアップで活躍するCFOたちが、企業の成長フェーズごとに変化する役割、事業成長への具体的な貢献、そしてCFOとしてのキャリアパスについて語ります。

16:40 – 17:25AI時代のスタートアップキャリアの考え方

AIが急速に進化する中、スタートアップでの働き方や求められるスキルセットはどう変わるのか。PKSHA Technologyの上野山勝也さんとSTORESの佐藤裕介さんに、AI時代のキャリア論を伺います。

-

PEARL LOUNGE

12:45 – 13:30スタートアップの急成長を支える人事

急成長スタートアップの現役人事が、自身のキャリアや役割、スタートアップならではの人事の魅力や課題、成長フェーズごとの業務の変化について、リアルな事例を交えて語ります。

13:40 – 14:25スタートアップの急成長を支えるエンプラセールス

急成長スタートアップの現役エンプラセールスが、自身のキャリアや役割、スタートアップならではのエンプラセールスの魅力や課題、成長フェーズごとの業務の変化について、リアルな事例を交えて語ります。

14:40 – 15:25スタートアップの急成長を支えるBizDev

急成長スタートアップの現役BizDevが、自身のキャリアや役割、スタートアップならではのBizDevの魅力や課題、成長フェーズごとの業務の変化について、リアルな事例を交えて語ります。

15:40 – 16:25

15:40 – 16:25スタートアップの急成長を支えるエンジニア

急成長スタートアップの現役エンジニアが、自身のキャリアや役割、スタートアップならではのエンジニアの魅力や課題、成長フェーズごとの業務の変化について、リアルな事例を交えて語ります。

Contents Contents

-

01

パネルディスカッション

業界を代表するスタートアップやメガベンチャーの最前線で活躍している経営者やCXO、ベンチャーキャピタリストの皆さんに登壇いただきます。「スタートアップのキャリア」を様々な角度から深掘りしていきます。

-

-

02

スタートアップ ピッチ

50社以上の参加スタートアップが、全身全霊で自社の事業内容や魅力をプレゼンしていきます。ネットの文字情報だけからでは絶対に感じ取れない、スタートアップ各社が持つ強烈な熱気を感じ取ってください。

-

-

03

企業別交流ラウンジ

ピッチに登壇した全スタートアップが交流ブースを出展しています。ファウンダーはじめ、経営陣や各職種で活躍している社員とアポなしで自由に立ち話をしながら、各社のカルチャーを体感することができます。

-

-

04

事前にオンラインでマッチ→1on1面談

参加チケットご購入後は、皆さん↔︎参加スタートアップ間でオンラインでお互いのプロフィールを閲覧できます。気になる相手がいた場合、メッセージを送り、イベント当日のカジュアル1on1面談を約束することができます。スタートアップ側から皆さんにメッセージが届くこともあります。会場内のスタンディングテーブルでカジュアルに社員の方と10分間の立ち話をする形式なので、少しでも気になるスタートアップがあれば気軽にアポを取ってみてください。

-

Startups

前回:Startup Aquarium 2024

Outline

参加対象者: スタートアップのキャリアに興味がある方(転職中の方も、中長期的なキャリアチェンジの可能性を模索したい方も大歓迎)

日時:

2025年3月15日(土)11:40-19:00(開場 11:00)

※多少前後する可能性があります

※出入り自由です

会場:

虎ノ門ヒルズフォーラム 4階・5階 東京都港区虎ノ門1-23-3 虎ノ門ヒルズ森タワー

アクセス:

銀座線:「虎ノ門駅」B4出口 徒歩約2分

日比谷線:「虎ノ門ヒルズ駅」中目黒方面改札よりB1出口直結A1出口 徒歩約2分、

北千住方面改札よりA2出口 徒歩約2分

事前確認:

※ 本登録フォームにてご登録いただいた情報は、Startup Aquarium 2025の出展企業(主にスタートアップ)に共有されます。ご登録いただいた皆様のご経歴内容を踏まえ、興味を持った出展企業からイベント当日およびイベント日以降の面談オファー連絡が届く場合があります。

※ また、本イベントへ登録することで、スタートアップ転職・副業希望者とCoral Capital投資先スタートアップをマッチングする転職・副業プラットフォーム「Coral Careers」への登録も同時に完了します。ご登録いただいた皆様のご経歴をもとに、興味を持ったスタートアップから面談希望の連絡が届きます。サービス詳細については、Coral Careersサービスページをご確認ください。

※ チケットの払い戻しは行えませんので、ご了承ください。

※営業目的の方、人材紹介業の方、採用目的の方、飲食目的の方など、キャリア検討とは異なる文脈でのご参加は固くお断りしております。その他、事務局がイベント趣旨に鑑み不適切と判断した場合は、参加登録が完了している場合でも、会場にてご入場をお断りさせていただく場合や、退場をお願いさせていただく場合がございます。その場合、返金は行いませんので、ご了承ください。

※ 取材ご希望の方は、別途Coral Capitalまでご連絡ください。