One trend that has hit the US but not Japan is private equity’s entrance into the startup world. When venture capitalists think about exits, they often think about 1) selling to a corporate; or 2) going public. However, there is a third option emerging, and that is selling to a private equity firm.

For those that are unfamiliar with private equity (PE), it is essentially the bigger brother of venture capital (VC). PE is the larger asset class within private investment world that focuses on finding established but underperforming companies, acquiring controlling stakes, and turning them around. PE looks for untapped value, while VC looks for growth. Up until now, these worlds rarely collided. PE people wear suits and VC people wear jeans. They are alien to each other. But that is changing, particularly in the world of Software-as-a-Service (SaaS).

PE folks in the US have begun to develop an appetite for SaaS because it is predictable and easy to understand. Since their businesses are subscription based and their metrics are well-defined, PE firms know how to model their returns fairly well now. And since the SaaS market has grown over the last 2 decades, there are plenty of companies that have predictable revenues but are not growing at VC expectations.

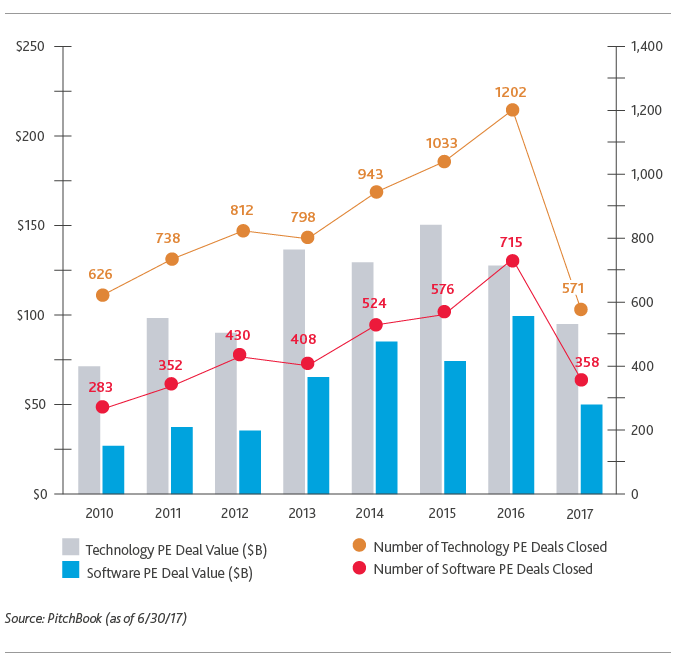

As a result, the number of US PE deals in SaaS increased by about 217% between 2010 and 2016 according to PitchBook. There are PE funds now, such as Vista Equity Partners and Think3, that focus exclusively on SaaS. Vista in particular has done well with this strategy. In September 2018, they announced their landmark sale of Marketo to Adobe for $4.75 billion, making $3 billion in just two years – their largest realized profit from a single company.

From a founder’s perspective, there are also some advantages to selling to a PE firm. When you sell to a big company, they often want you to stay, so they’ll structure the deal so that your payout is distributed over time. However, PE firms often don’t care whether you stay or not. In fact, in some cases they may prefer that you don’t. They may want to put in their own management. So if you’ve built a solid cash generating business, but no longer feel motivated to stick around, PE firms can be a great fit. The downside is that they will likely pay less than other options. PE firms are value investors, and therefore will look for discounts by comparing you to benchmarks such as public companies or other similar acquisitions in the space.

As the SaaS market continues to grow in Japan, I think there will be a similar opportunity for the private equity and venture worlds to work together. Japan is the largest SaaS market in Asia, and is expected to remain the leader both in terms of size and growth. It is inevitable that as more SaaS companies emerge, private equity players will begin to look this way. If there are any reading this post that are curious to learn more, feel free to reach out.