I love Japan.

I have a U.S. passport, but I have spent the majority of my life here. My sense of identity is layered. I am proud to be American, and I am equally proud to be part of Japan. It is an incredible place with extraordinarily talented and hardworking people. Yet it remains chronically underestimated, even by Japanese themselves.

Time and time again, Japan has reached heights not thought possible. After hundreds of years of isolation and technological stagnation during the Edo period, Japan transformed itself in just three decades and went on to join the League of Nations as the only Asian country recognized as a great power. Then, from the ashes of World War II, it rose again within another three decades to join the G5, once more as the only Asian country included. The fact that Japan managed a second rise within the same timeframe, rising “vertically rather than horizontally,” as envisioned by MacArthur, is a testament to its underlying strength.

The year I was born, 1989, marked the end of that era and the beginning of what came to be known as the Lost Decades. In a strange way, the bursting of the bubble was not a big enough shock to the system. Unlike the arrival of the Black Ships that ended the Edo period, or the total devastation of World War II, the economic collapse of the 1990s did not force immediate and drastic reinvention. Instead, it led to a slow decline. A long boil. More like a slow-growing cancer than a heart attack.

As we enter 2026, that temperature has changed.

The “shoganai” attitude that started in the Heisei era is colliding with geopolitical and economic realities that make passivity impossible. Japan has grown poorer relative to the rest of the world. The yen has weakened dramatically. Demographics are no longer an abstract future problem. China’s rise is destabilizing Pax Americana. The margin for error is gone.

Japanese often say “pinchi wa chansu,” or “a crisis is an opportunity.”

This backdrop is creating an opening for Japan’s third rise. It is also a core thesis we are investing heavily in at Coral Capital.

The Geopolitical Tailwinds

The United States is now contending with a classic Thucydides Trap against China. The resulting decoupling is the greatest economic opportunity for Japan since the Korean War.

Japan is already the United States’ most important ally. It is the largest foreign investor in the U.S. and the top foreign employer of Americans. As the U.S. moves to de-risk its supply chains, it is becoming increasingly clear that Japan is not optional. It is indispensable.

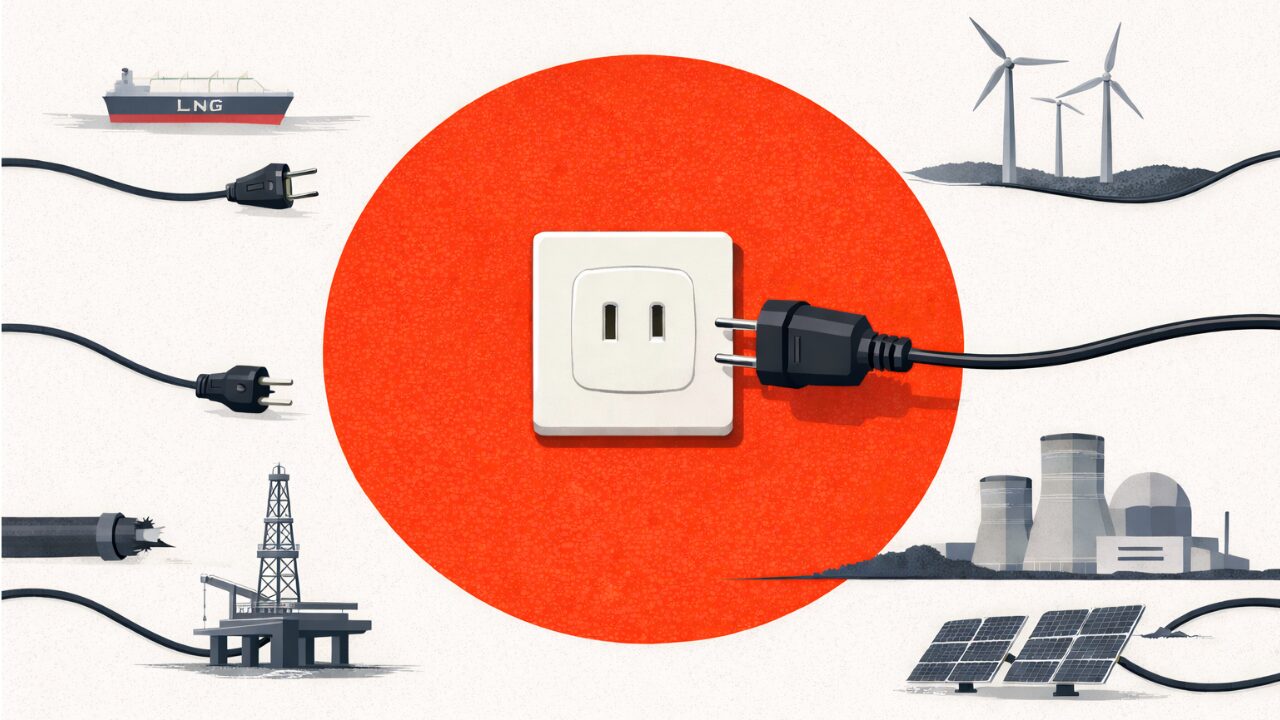

Semiconductors offer a clear example. While global attention fixates on Taiwan and TSMC as the choke point of the AI race, the reality of the stack is more complex. Japan holds an oligopolistic grip on the fundamental physics of computing.

Japanese companies control:

- more than 80% of the global photoresist market

- more than 70% of photoactive raw materials

- over 50% of silicon wafers

- nearly 100% of advanced packaging substrates

Even if China were to make a move on Taiwan, they would still need Japan to continue progress in AI and advanced computing.

And semiconductors are only one example. Across robotics, advanced materials, nuclear energy, and other hard technology domains, the global ecosystem cannot function without Japan. Japan never left the global stage. It simply retreated into the supply chain, becoming less visible to consumers while remaining indispensable to industry.

The Thesis: U.S.–Japan Partnership

This third rise will not resemble the previous two. It will not be driven solely by domestic conglomerates exporting finished goods. It will be driven by deep, bidirectional integration between Japan and the United States.

Our thesis for 2026 is simple. The U.S. needs Japanese hardware, and Japan needs U.S. scale.

For U.S. founders: Build with Japan

The United States wants to rebuild critical industries such as nuclear energy, robotics, and semiconductors, but it faces real bottlenecks in manufacturing capacity. The fastest path to de-risking away from China is not isolation, but partnership with Japan’s industrial base.

- Supply chain: Access high-precision components no longer available elsewhere

- IP protection: Operate under a stable rule of law unlike many alternative manufacturing hubs

- Talent: Work with an engineering workforce grounded in “monozukuri,” a culture of craftsmanship

For Japanese founders: Win in the United States

For founders building in deep tech and critical industries, the domestic market is no longer the ceiling. It is the launchpad. The products being built in Japan today, in defense, energy, and materials, are increasingly matters of national security for the United States.

- Go global on day one: Do not wait to win Japan before expanding abroad

- Strategic alignment: The U.S. government and industry are actively seeking non-Chinese suppliers. You are the solution they need

- Ambition: The goal is not to become a vendor, but to define the category globally

The Vibe Shift

I have often said that America’s greatest strength is its “irrational optimism,” while Japan’s greatest weakness since 1989 has been its “irrational pessimism.” This is not a permanent trait. In earlier eras, Japan’s confidence bordered on audacity, and that confidence produced outcomes that exceeded even its own expectations.

We are beginning to see early signs of that confidence returning.

Regardless of one’s political views, the rhetoric coming from the new administration under Sanae Takaichi represents a meaningful shift. The focus on 17 strategic sectors, ranging from nuclear energy to quantum computing and defense, signals a move away from managing decline toward engineering growth. The challenges are real, but the framing has changed from “how do we survive” to “how do we win.”

That shift in sentiment matters. Confidence is a prerequisite for execution.

It is one of the reasons I am more optimistic about Japan’s future than at any point in my lifetime.

Our Commitment in 2026

Executing on this third rise will require bridges. It requires close collaboration between startups and large enterprises, both domestically and internationally.

At Coral Capital, we are not just observing this shift. We are actively funding it and supporting it. We have already deployed capital into semiconductors, nuclear energy, robotics, defense and other industries critical in this era.

In 2026, we are running hard at this thesis. We are looking for Japanese founders ready to attack global markets, and U.S. founders who understand that the path to scale increasingly runs through Tokyo. Our role is to serve as a facilitator for this trans-Pacific integration.

The United States needs Japan, and Japan needs the United States.

The lost decades are over. It is time to get back to work.