Japan was dealt a bad hand. It is an industrial superpower trapped on a resource-poor archipelago, devoid of oil, gas, or coal. For the last century, this geological reality has dictated Japan’s geopolitical destiny. It drove the nation into war with the United States in the 1940s, and shocked the economy during the oil shock of the 1970s.

In 2022, this vulnerability was exposed once again. The “triple punch” of the Ukraine war driving up energy prices, the widening interest rate gap between the US and Japan, and the resulting collapse of the Yen battered the economy.

Japan is in a tight spot when it comes to energy sovereignty, but it doesn’t have to be this way. Japan already figured out a way to depend less on other nations: nuclear energy.

The First Pivot: When Japan Built the Future

Japan’s leadership in nuclear energy wasn’t an accident, but a survival strategy.

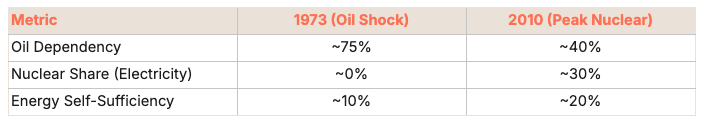

To understand the glory days of Japanese nuclear construction, we should go back to 1973. In that year, Japan’s dependence on oil stood at a staggering 75.5% of its primary energy supply, virtually all of which was imported from the volatile Middle East. The Arab oil embargo triggered by the Yom Kippur War sent shockwaves through the Japanese economy, which was uniquely susceptible among industrialized nations due to its energy-intensive manufacturing base. The sudden tightening of supply and the quadrupling of prices catalyzed a national consensus that energy security was synonymous with national survival. Prime Minister Kakuei Tanaka stated in the Diet, “We are determined to promote nuclear power” and by 1974, a law was enacted to provide subsidies and encourage the construction of power plants.

The “Glory Days” of Energy Independence

Japan didn’t just buy these reactors but became a key part of the global supply chain. The ultimate proof of this dominance lies in Muroran, Hokkaido. For decades, Japan Steel Works (JSW) has held a virtual global monopoly (approx. 80% market share) on the large steel forgings required for reactor pressure vessels. Whether it was a French EPR or an American AP1000, the massive steel heart of the reactor likely came from Japan. Japan was becoming the foundry for the global atomic age.

Japan also perfected next-generation technology, only to leave it on the shelf. While the world focused on conventional light water reactors, the Japan Atomic Energy Agency (JAEA) spent decades refining the High-Temperature Gas-cooled Reactor (HTGR). Their flagship testbed, the HTTR, achieved a world-record outlet temperature of 950°C. Unlike standard reactors that operate at ~300°C and are limited to electricity, this level of heat can decarbonize heavy industry and produce hydrogen. And crucially, the design is inherently meltdown-proof because it cools itself naturally, without relying on electric pumps that can fail.

This was an incredible testament to Japanese technical prowess. Yet, for thirty years, this superior technology remained commercially dormant, treated as a perpetual research project rather than an industrial solution. It wasn’t until recently that our portfolio company Zettajoule and Mitsubishi Heavy Industries began commercializing this latent Japanese IP, modernizing JAEA’s proven designs and deploying them.

The Short-Sighted Setback

Then came 2011. The Great East Japan Earthquake was a natural disaster of biblical proportions, but the “nuclear disaster” that followed was largely a disaster of panic and short-sighted policy.

While the meltdown at Fukushima Daiichi was a serious industrial accident, the subsequent shutting down of the entire nuclear fleet was an emotional overcorrection that ignored the data. The death toll directly attributable to radiation at Fukushima is zero.

The zero nuclear era has been economically ruinous. To replace its nuclear baseload, Japan resorted to burning imported liquid natural gas (LNG) and coal. The bill came due in 2022. Exacerbated by the Ukraine war, energy import costs surged, driving Japan to record its largest trade deficit in history—¥20.0 trillion.

Simultaneously, the US Federal Reserve raised interest rates while the Bank of Japan kept them low. This interest rate differential is often blamed for the weak Yen, but the trade deficit was also a devastating blow. When a nation must sell its currency to buy 90% of its energy in US dollars, its currency depreciates. Every nuclear plant that remains offline is a vote to transfer national wealth to foreign energy exporters.

The Global Race: Urgency and Opportunity

While Japan hesitated, others sprinted. China has been executing an unprecedented ramp up of nuclear construction. In 2025 alone, China approved 10 new reactors. They are standardizing designs and building at a pace not seen since the 1970s. China aims to have 200 GW of nuclear capacity by the 2030s, surpassing the United States. They are doing exactly what Japan did, but faster.

The United States is also waking up. Tech giants like Microsoft, Google, and Oracle are pouring billions into nuclear power to feed the voracious appetite of artificial intelligence. Data centers require 24/7 baseload power that wind and solar simply cannot provide without prohibitively expensive battery storage.

Japan is Going Nuclear Again

Thankfully, Japan is rebooting its nuclear industry. After over a decade of excessive caution, Japan is waking up to the reality that serious nations build serious infrastructure.

The recent Strategic Energy Plan updates have formally ended the zero nuclear era. The government has committed to a 20% nuclear share by 2030, explicitly acknowledging that the fantasy of running a Tier-1 manufacturing economy solely on intermittent renewables was never going to work. With 14 reactors now back online, Japan is ramping up again. While I believe that this is not nearly ambitious enough, it is definitely a start.

Japan is also investing in what’s next, leveraging its existing supply chain dominance to leapfrog into fusion. In late 2025, the private-sector-led “FAST” project (Fusion by Advanced Superconducting Tokamak) completed its conceptual design, with construction targeted for 2028. Unlike Western counterparts often trapped in science experiment purgatory, our portfolio company Kyoto Fusioneering is already shipping critical hardware (gyrotrons and thermal loops) effectively selling the picks and shovels for the global fusion race. If Japan cracks fusion, it will be the holy grail of energy sovereignty. It is no wonder why Takaichi is so bullish.

If Japan can get over the politics and misguided stigma around nuclear energy, the upside is enormous. Every gigawatt brought back online strengthens the Yen, narrows the trade deficit, stabilizes industrial costs, and restores autonomy. Japan already has the engineers, the supply chain, the operating know-how, and the regulatory scars to do this safely. Few countries do. Nuclear is the backbone of Japan’s future. A nation that once built the global atomic supply chain can do so again, this time with better technology, harder lessons learned, and a clearer understanding that energy sovereignty is national power.